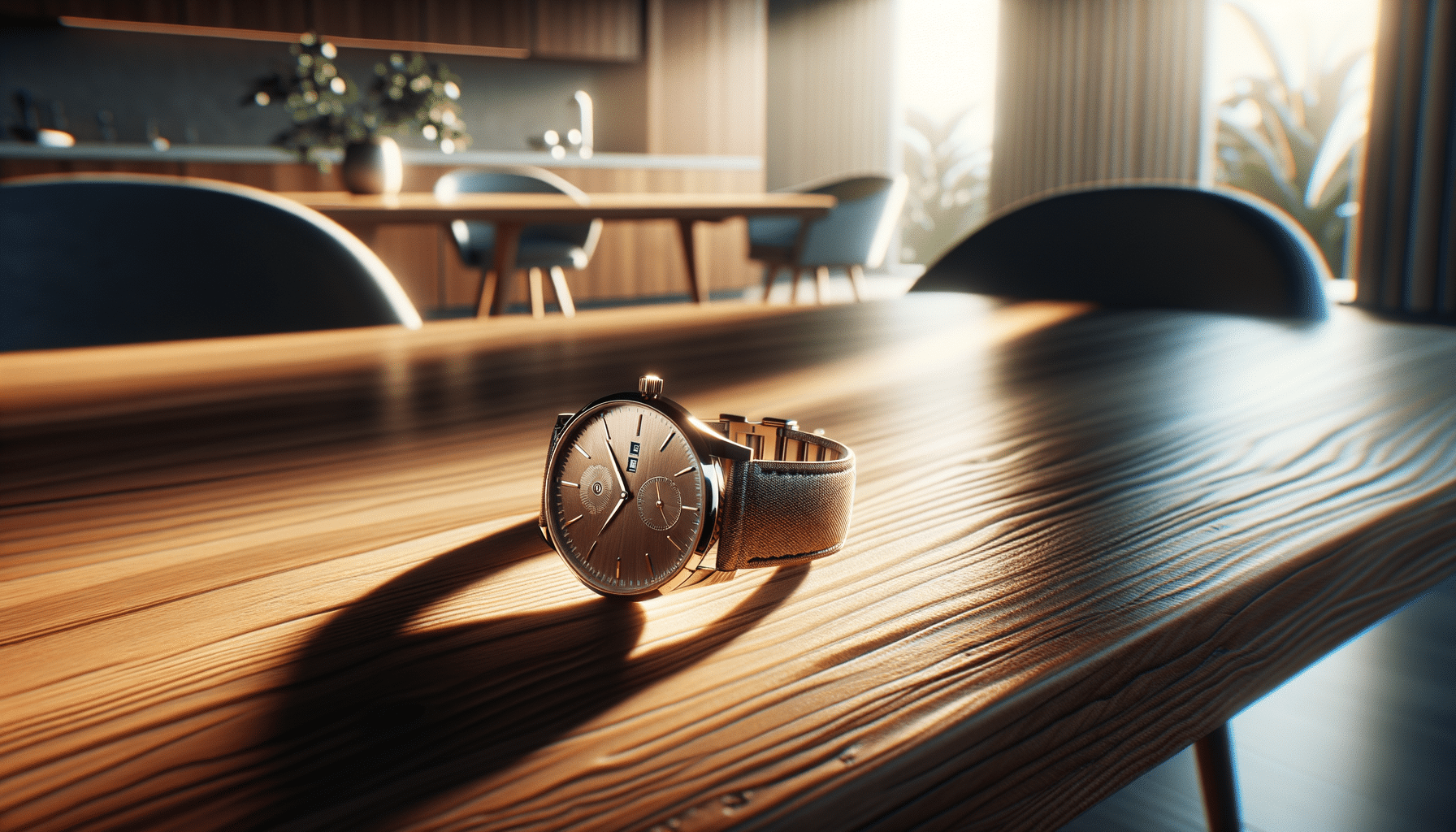

Understanding Watch Financing Options

Introduction to Watch Financing Options

In the realm of luxury watches, owning a piece of timeless craftsmanship can be a significant investment. However, not everyone is prepared to make a full payment upfront. This is where watch financing options come into play. These plans provide flexibility and accessibility to a broader audience, allowing enthusiasts to enjoy luxury watches without the immediate financial burden. This article delves into various financing options, such as lease-to-own plans, interest rate comparisons, and credit requirements, offering a comprehensive guide for potential buyers.

Exploring Lease-to-Own Plans for Luxury Watches

Lease-to-own plans have gained popularity among luxury watch enthusiasts as a viable option to acquire high-end timepieces. These arrangements allow individuals to lease a watch for a specified period, with the option to purchase it at the end of the term. This model provides a flexible path to ownership, spreading the cost over time and minimizing the initial financial commitment.

One of the primary advantages of lease-to-own plans is the ability to enjoy a luxury watch without the need for a large upfront payment. It allows buyers to experience the watch’s quality and craftsmanship before committing to a purchase. Additionally, these plans often come with maintenance and warranty coverage, ensuring that the watch remains in pristine condition throughout the lease term.

However, potential buyers should be aware of the terms and conditions of such plans. It’s crucial to understand the total cost of ownership, including any interest or fees associated with the lease. Additionally, evaluating the buyout option at the end of the lease term is essential to ensure it aligns with your financial goals. By carefully considering these aspects, lease-to-own plans can be a practical and accessible way to own a luxury timepiece.

Comparing Interest Rates on Watch Financing

When considering watch financing, comparing interest rates is a critical step in making an informed decision. Interest rates can vary significantly based on the lender, the buyer’s creditworthiness, and the terms of the financing plan. Understanding these variations can help potential buyers select a plan that offers the most favorable terms.

Interest rates on watch financing can range from zero percent for promotional offers to higher rates for extended payment plans. It’s essential to scrutinize the details of each offer, as promotional rates may only apply for a limited time, after which a higher rate could take effect. Buyers should calculate the total interest paid over the life of the loan to understand the true cost of financing.

Additionally, some financing plans may offer fixed interest rates, providing stability in monthly payments, while others might have variable rates that could fluctuate over time. It’s advisable to consider your financial situation and risk tolerance when choosing between these options. By comparing interest rates and understanding their implications, buyers can make a well-informed decision that aligns with their financial strategy.

Understanding Credit Requirements for Watch Financing

Credit requirements play a pivotal role in determining eligibility for watch financing. Lenders typically assess a buyer’s credit score, income, and financial history to evaluate the risk of extending credit. Understanding these requirements can help potential buyers prepare and improve their chances of securing favorable financing terms.

Generally, a higher credit score translates to better financing options, including lower interest rates and more flexible terms. Buyers with lower credit scores may still qualify for financing but might face higher interest rates or stricter terms. It’s beneficial to review your credit report before applying for financing to identify any discrepancies or areas for improvement.

In addition to credit scores, lenders may consider factors such as income stability and debt-to-income ratio. Demonstrating a reliable income source and manageable debt levels can enhance your creditworthiness. For those looking to improve their credit standing, strategies such as timely bill payments, reducing outstanding debts, and avoiding new credit inquiries can be effective. By understanding and meeting credit requirements, buyers can enhance their financing options and make informed decisions when acquiring a luxury watch.

Conclusion: Making Informed Decisions in Watch Financing

Acquiring a luxury watch is not just about owning a timepiece; it’s about making a statement of style and sophistication. Financing options, such as lease-to-own plans, interest rate comparisons, and credit requirements, provide pathways to ownership that cater to different financial situations. By exploring these options, potential buyers can enjoy the elegance of a luxury watch without compromising their financial well-being.

When navigating watch financing, it’s essential to conduct thorough research, compare offers, and understand the implications of each option. Whether you’re drawn to the flexibility of lease-to-own plans, the savings from favorable interest rates, or the eligibility determined by credit requirements, making informed decisions will ensure a satisfying and financially responsible purchase.

Ultimately, the journey to owning a luxury watch should be as rewarding as the timepiece itself. By leveraging available financing options, enthusiasts can embrace their passion for horology while maintaining financial stability.